The Indian chocolate market grew at a CAGR of 12% in the years preceding 2012, and was expected by forecasts to accelerate since then at a CAGR of 20% for the next five years. Chocolate consumption in the country is likely to be in the region of US$ 3 to 3.2 billion or Rs. 21,500 crore, according to global market intelligence agency, Mintel.

Global confectionary and food giants like Ferrero and Nestle dominate the market in India

with more than 65% share of the overall chocolate market, according to the India Chocolate Market Outlook, 2022 by Research and Markets. However, homegrown brands like Amul are rising in market share and even taking a share in in the upswing in the boutique chocolate production for luxury, holiday, and niche markets such as sugar-free bars and dark chocolates. Amul has upgraded its plant in Mogar for Rs. 300 crore aiming to produce 1,000 tons of chocolate annually.

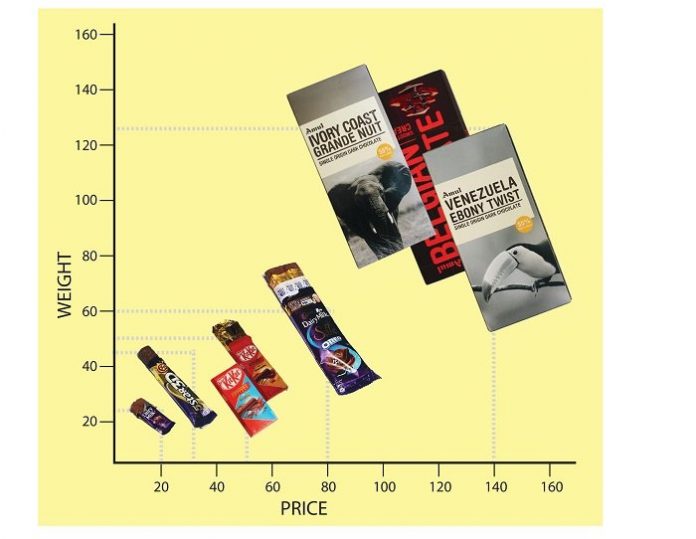

However, category demarcation is sometimes blurred and overlap in an extremely bouyant market with domestic producers contesting global brands. A visit to a national supermarket chain in Noida’s Great India Place mall revealed an entire section dedicated to chocolates with its own refrigerated display cases and checkout counter. At first glance, two dozen

brands with as many as a thousand SKUs vied with each other in brand designated spaces.

Amul’s single origin dark chocolates

Home brand Amul has stepped up by expanding its chocolate range. It has introduced high cocoa content dark chocolate variants under ‘single origin dark chocolates.’

Home brand Amul has stepped up by expanding its chocolate range. It has introduced high cocoa content dark chocolate variants under ‘single origin dark chocolates.’

In recent years, dark chocolate has gained popularity because of its so-called health benefits. Consumers in India are progressively adapting to the taste of dark chocolates, often as a mark of sophistication.

Amul recently introduced its range of single origin dark chocolates, with 55% cocoa content, in seven variants – The Ecuador Tropical Dusk, Colombia Classique Black, Madagascar Noir De Cacao, Ivory Coast Grande Nuit, Tanzania Chocolat Noir, Peru Dark Amazon and Venezuela Ebony Twist.

Apart from the mystique of the names that evoke far away jungles, the packaging of the single origin range depicts the endemic species of each of the seven locations on the front of the packaging. In order to give a gourmet appeal to the product, the packaging of each variant describes itself in context to its origin.

origin dark chocolate carton box.

Photo PSA

Apart from the nutritional information, the single origin range displays the ‘Taste Profile Chart,’ a circular geo-spatial diagram which breaks down the taste of the bar in terms of nuts, caramel, spices, sweetness, wood, cacao, astringency, bitterness, cream, color, roundedness, and acidity for a connoisseur of chocolates. The implication is that this is a somewhat scientific analysis of ingredients and the senses and taste buds in a bid to arouse connoisseurship akin to wine.

The outer carton packaging uses a base of black with monochrome photographs of the animals and birds particular to the geography that is part of the varietal announced in bold brown embossed lettering. The orange used for the price sticker is also used for the reverse printed information on the black back of the pack and quite usefully for the ‘Taste Profile Chart.’ The flexible pouch containing the chocolate is a metallized foil – gold on the inside and black outside.

Overall, the packaging creates an aura of sophistication from the animal, bird, and geographic names, to the taste profiles in what are actually plain dark chocolates in large servings meant for the fridge. Chocolates in cartons are generally higher priced in comparison to the on-the-go and lower priced chocolates that now come in flexible packaging instead of their former combination of paper sleeves and foil wrappers.

Overall, the packaging creates an aura of sophistication from the animal, bird, and geographic names, to the taste profiles in what are actually plain dark chocolates in large servings meant for the fridge. Chocolates in cartons are generally higher priced in comparison to the on-the-go and lower priced chocolates that now come in flexible packaging instead of their former combination of paper sleeves and foil wrappers.

RS Sodhi, managing director of Amul claims, “The aim is to upgrade existingchocolate consumers from sugar-rich to cocoa-rich experience. We are the only player to have cocoa content of up to 75% in our dark chocolates. Soon, we will be launching chocolates with 90% cocoa-content and going up to 100%. Amul chocolates have created a new niche in the chocolate industry.”

Cadbury product combinations

With increasing westernization in Indian culture and traditions, Indian foods, from regional dishes to chocolates, have seen new combinations and transformation. Catering to this hunger for fusion, Cadbury introduced a range of customized premium chocolates that combine two different products.

Cadbury Dairy Milk Silk Oreo is one such product by the brand that fuses chocolate with the globally successful Oreo sandwich cookie. Using its consumer insights and innovation capabilities, Cadbury is extending its footprint to a wider Indian market. Another Cadbury chocolate combination uses candy beans.

The purple and gold packaging of Cadbury remains a classic ever since its launch in late 1980s. In order to reflect the changing times, Cadbury updated its packaging and introduced a silver foil inside its flexible packaging in the 1930s moving to gold foil in 1970s.

The company now uses flexible packaging with a layer of paper on the bar in its premium range. However, its lower priced bars for the quick on-the-go mass market use only flexible packaging which reduces the overall cost of manufacturing. In the on-the-go and energy segment, Cadbury has added crunch crispies to the classic chewy caramel 5 Star bar as a new variant in a flexible pouch at Rs. 30.

Nestlé updates an iconic product

Packaging must be in harmony with supply chain, regulatory requirements in terms of safety, product information and, disposability. Moreover, the use of biodegradable and sustainable material is also necessary in the light of environmental issues. These factors are to be incorporated in packaging design while keeping it cost effective.

Nestlé claims it is influenced by these factors and the company has taken measures to balance brand security, cost and consumer preference. On 10 April 2018, Nestlé announced its aim to make its packaging 100% recyclable or reusable by 2025. The brand aspires to avoid plastics in its packaging and that none of its packaging is dumped in landfills. The implication that Nestle will do away with flexible packaging needs further enquiry, especially in the Indian context.

An innovative update of the iconic KitKat bar under its range ‘dessert delight’ was introduced by Nestlé last year. The packaging displays the premium chocolate that is the combination of the classic KitKat bar, retaining the crunch of the original but flavoring it with popular desserts such as truffles and puddings. The chocolates come in cartons to add to its value as a premium product. Inside the carton, the chocolates are protected by gold foil.

Conclusion

Chocolate brands in India are creating market differentiation by introducing new varieties and approaches to traditional packaging. Brands such as Amul have introduced affordable premium chocolates protected by flexible pouches within sophisticated cartons to appeal to a segment of the middle class population. In order to lower the overall manufacturing cost of a chocolate, flexible pouches are used for smaller and low-priced portions while cartons and are used for premium chocolates.

Hence, manufacturers are using different packaging techniques as a tool to make chocolates desirable and affordable. While cartons and multiple layers add to sophistication, the on-the-go segement of chocolates contain lesser layers of packaging.