In the past four years, substantial biaxial film manufacturing capacity has been added in India. Approximately two dozen lines for BOPET and BOPP have been installed. While in the past, the Indian flexible packaging industry has preferred to invest in polyester lines, there seems to be a shift toward BOPP or polypropylene. Also in the pipeline is a hybrid BOPP/PE line giving flexibility based on market demand.

Of the approximately dozen biaxial lines still to be installed by the end of 2026, five have been shipped and another seven machines are likely to be shipped in 2025 and possibly 2026. The five lines already shipped are BOPP lines, which should be installed and commissioned in the first half of 2025. The balance of the seven lines ordered comprises five BOPP lines and two BOPET lines, which are likely to be shipped, installed, and commissioned by the end of 2026. The BOPET or polyester lines were ordered earlier and have been mostly installed, while the BOPP lines were ordered later and will continue to be installed in the next two years.

The addition of the dozen biaxial lines over the next two years will add approximately 600,000 tons of ‘nameplate’ film capacity over the next two years. Altogether this means that the nameplate capacity of the BOPP lines will rise to 1.7 million tons and the BOPET ‘nameplate’ capacity will reach 1.65 million tons by 2026.

While the existing installed biaxial film capacity in India is more for polyester or BOPET, it seems that parity is coming for BOPP (biaxally oriented polypropylene) lines with the commissioning of the lines currently on order. Polyester has been dominant in the Indian flexible packaging industry, which is now emulating other markets where BOPP is seen as more sustainable and amenable to single-family polymer structures. While polyester films are seen as a versatile material with good mechanical properties for producing laminates for products, including food that requires good barrier properties, it is likely that with the stricter enforcement of the waste management rules notified in February 2022, there will be some shift to BOPP laminates that also have good moisture barrier properties. Especially interesting is the hybrid BOPP/PE line that Toppan Speciality Films plans to commission in its North India plant.

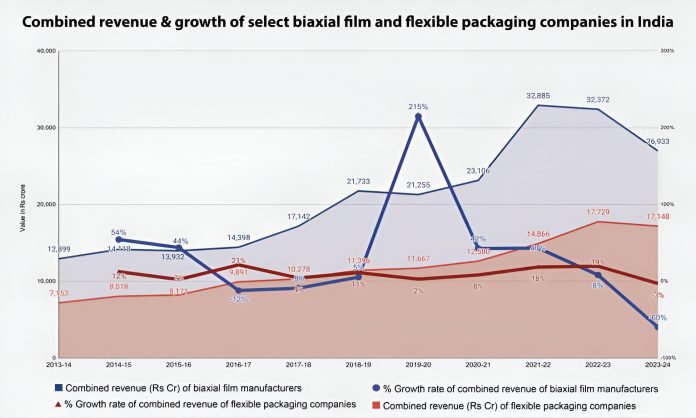

Readers should note that in the accompanying graph in we have looked at the turnovers of 12 biaxial film manufacturing companies for whom we have data up to FY 2023-24. The data shows that the combined turnover of these companies has declined over these years. From Rs 32,685 crore in FY 2021-22, it declined slightly to Rs 32,373 crore in FY 2022-23. From FY 2022-23 to FY 2023-24 the combined turnover declined more steeply to Rs 26,933 crore. This decline is attributed mainly to the low price realization of BOPET or polyester films.

Blown film lines

While more than a hundred blown film extrusion lines are installed in India each year, the overwhelming majority are low-capacity lines with capacities from 50 to 400 kilograms an hour. Indian suppliers such as Rajoo, Kabra, Mamta, and Shubham do supply higher-capacity multilayer lines and are also exporters.

However, the trend in the flexible packaging industry is to invest in higher technology and automation to increase the throughput and minimize wastage and changeover times – and for this, approximately 10 to 12 blown films will be imported and installed this year from suppliers such as W&H, Machhi, Hosokawa Alpine and Reifenhauser. For W&H and Macchi, which will supply and commission a majority of the imported blown film lines till March 2025, the order book going into the next year seems relatively healthy with several interesting high-value orders in the pipeline.

It must be noted that the flexible film market has been relatively flat over the past couple of years with erratic demand for FMCG and food packaging. At times there has been fierce competition, especially for polyester films, which have become commoditized and produced merely to keep the machines running and top lines from collapsing.

Moreover, although blown film lines with MDO are still being imported, these are just a trickle with one or two at most each year. According to industry insiders, the domestic market for MDO PE films may take another five years to develop.