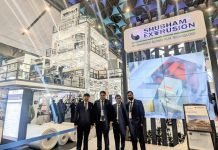

On February 1st, the first day of the PlastFocus exhibition at the new Yashabhoomi exhibition centre in West Delhi, we had the opportunity to meet the management of Windmöller & Hölscher. We met Dr Falco Paepenmüller, chief executive officer, Dr Sascha Witt, chief sales officer and Shri Prakash Werlemann-Gupta, managing director Middle East, Africa and India. In addition, Anuj Sahni, the company’s sales and Marketing Director for India, also joined our discussion to update us and our readers on the company’s outlook for the industry, and in particular the Indian and South Asian markets.

A PlastFocus, we spoke to the W&H executives about market growth in India and Asia, as well as industry topics such as new, sustainable structures and changes in technology and automation. In response to our question about machine builders increasingly talking about applications and new structures, Dr Paepenmüller said, “New mono-material structures are in demand from most of the major brand owners and customers are increasingly interested in mono-material applications. We are showing what new sustainable or more laterally recyclable structures are possible with our extrusion lines and what the potential applications are in different consumer segments and applications. So, if you look at our stand here at Plastfocus, you will see not only machines, but also applications.”

We asked about the trend that seems to have taken hold in India of adding cast film lines in addition to the many biaxial lines that have been added in recent years and continue to be installed. Would this lead to overcapacity and depress prices for certain packaging films? Dr Paepenmüller answered, “More lines and higher capacities naturally intensify the price war – this is currently most evident in standard products, where capacities are already high. The special characteristic of our blown and cast film lines is their fit for producing specialty films. The higher the added value of the film, the less it is subject to the price war for standard products.”

When queried particularly about the use of an annealing process on a W&H Varex blown film line instead of the MDO process and whether they are similar or interchangeable, Dr Paepenmüller explained, “Put simply, MDO and annealing both modify the film in some way. However, they are not interchangeable. MDO enables different film properties due to the stretching process, whereas annealing does not. MDO is currently the predominant technology for the production of mono-material films made of PE, a growth market driven by the trend towards sustainability. This area is also an opportunity to break away from the price-contested market of standard applications. And what is particularly attractive is that our MDOs are retrofittable,” adding, “One case where annealing is installed more frequently is the Aquarex, our water-quench blown film line which extrudes downwards and uses water instead of air as cooling medium. The result is a film with a striking gloss, high transparency and exceptional puncture and tear resistance. The Aquarex is particularly interesting for customers who want to tap into highly specialized niche markets such as medical applications and thermoforming films.”

When we ask about the increased automation on W&H blown film lines and presses, Dr Witt commented, “Our customers, like all employers, are faced with the global challenge of finding qualified people, so automation is key. In recent years, we have developed automations to make the machine more independent and to support the operator. For example, the EASY2 Change assistance system for our blown film lines supports the operator in every step of a product changeover. Compared to an experienced operator, the number of klicks required for a product change is reduced by more than 70% and the time required is cut by more than half – all with the assurance that no mistakes will be made.”

He also answered our question about the growth of the industry in general and India and South Asia in particular. “India, South Asia and the Asia-Pacific region is an important and growing market because as the population grows and the wealth of these societies increases, the demand for high technology will also increase. The flexible packaging market is growing in all film segments, but particularly in specialty films. We at W&H have been able to participate in this growth over the past few years and are grateful for the trusted and long-term customer relationships we have been able to build.”

We change the subject a bit and ask about the progress of the W&H Indian hub in New Delhi and the contribution of the software development team to the company. Shri Prakash Werlemann-Gupta commented, “W&H opened a liaison office in India in 1993 after years of scouting the Indian market from Europe. Our aim was to use the organization primarily for service and we started the service station in 1997 with 4 technicians. Today, our team of 159 people across Africa, the Middle East and the Indian subcontinent is dedicated to going above and beyond to ensure customer satisfaction. India is our headquarters to provide the whole region with local service and a crew dedicated to their needs. We have a highly skilled service staff trained in Germany and every member of this team speaks German in addition to being ‘German engineered.’”